Nationwide Real Estate Investor Products

6.77% 30 Year Fixed

80% Cash Out / Purchase

Rent Schedules Allowed

Seasoning Exceptions

1-8 Units

$50k - $2m

640 Score

Higher Score Of 2 Borrowers

Finance 10% Assignment Fee

90% Purchase Advance

100% Rehab Funded

Finance 10% Assignment Fees

$0 Reserve / No Bank Stmt

Self GC Allowed

$100k - $2m

9.75% 18mo Interest Only

660 Score (Higher of 2)

Higher Score of 2 Borrowers

80% Advance of Total

Down Payment Credit For Lot Owned Or Equity in Lot

9.75% 24 Months Interest Only

Self GC Allowed

$200k - $2m

3 Day Daws & Inspections

1-4 Units

80% No Value Add

Most Property Types

Optional Rehab Reserve

Finance 10% Assignment Fees

No Doc & Fund Sourcing

9.75% 18mo Interest Only

$100k - $10m Bridge

Expanded Options Per Market

Gap & DP - Case By Case

Recent Portfolio "Hard Money" Transactions

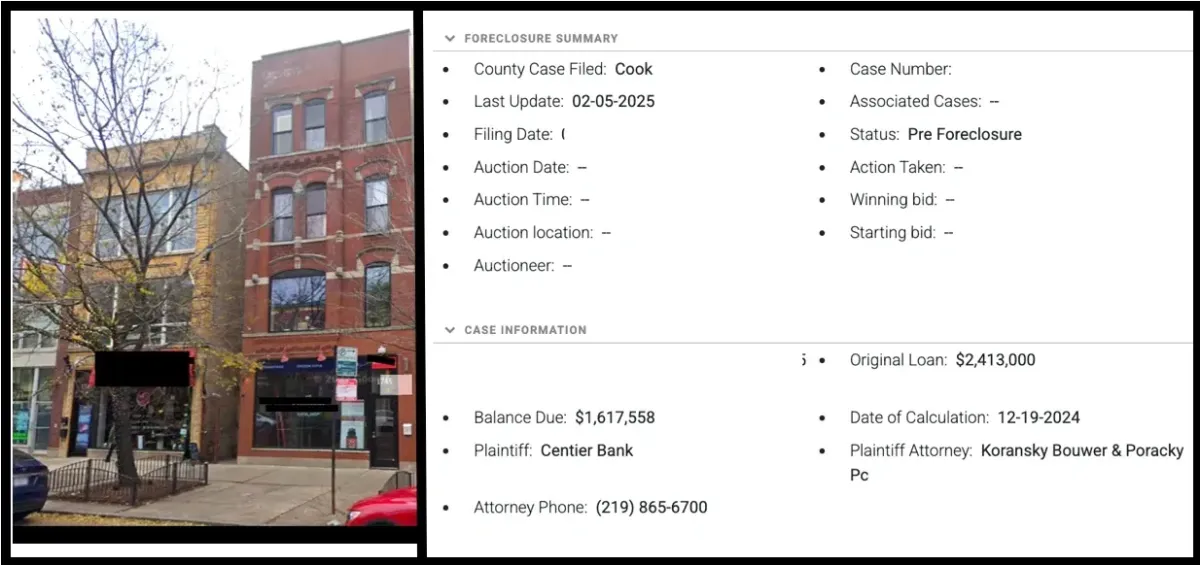

Chicago - Foreclosure Bailout - Mixed Use 18mo Short Term Bridge

Protecting Equity and Business Income by Providing Emergency Funding To Stop Foreclosure

Brian reached out to an experienced investor he noticed on the foreclosure docket. This case was unusual, as there was approximately 40% equity in the property. It had a 10-year balloon, which is common for commercial properties. When the loan came due, the bank chose not to refinance the borrower’s loan into a long-term solution. The borrower was facing financial hardship and didn’t have the time to refinance through another bank.

Once a loan enters foreclosure, most banks typically refuse to approve any refinancing. We were able to bridge the gap by funding the deal, providing the borrower with cash to help alleviate his hardship and halt the foreclosure process. This was structured as an 18-month loan, allowing the borrower ample time to secure permanent financing. The borrower not only had his equity at stake but also operated his business from the property, so our bridge solution was crucial in saving both his investment and his business.

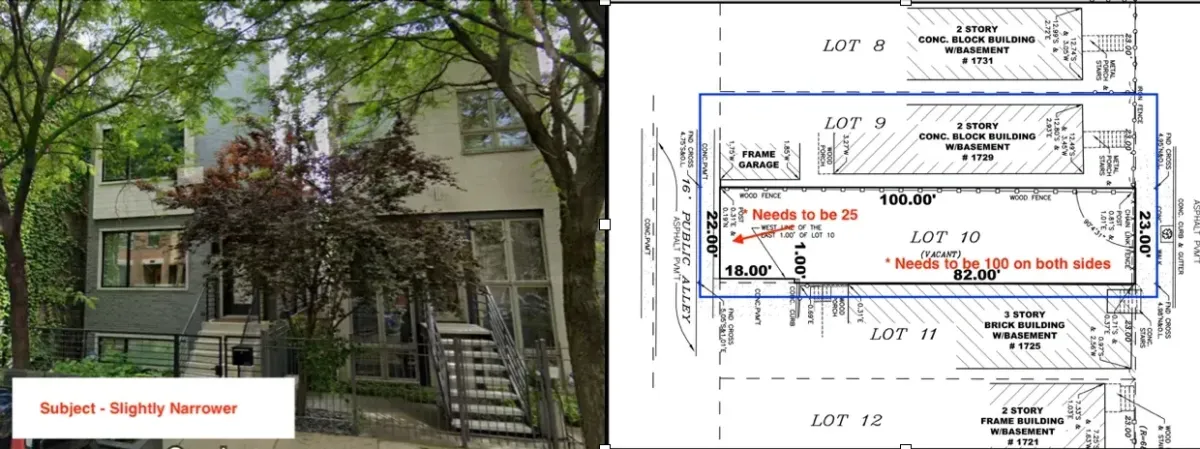

Wicker Park - Ground Up Construction Single Family $1.1m

Facilitated a Variance and Negotiated a Settlement To Clear Title on an Incredible REO Lot Sale

Brian collaborated with a local bank on an REO involving a vacant lot that was an incredible deal at $130,000. The potential resale value for the ground-up construction was over $1 million. This opportunity arose because the original developer was unable to secure the necessary variance to build. Additionally, we did not have clear title because the developer who owned the property next door was suing the bank over a lot line dispute.

Before closing, we successfully facilitated the variance with the Alderman and an expediter, ensuring that the borrower could obtain permits quickly. We also negotiated a cash buyout with the developer, leading him to drop the pending litigation. The borrower agreed to pay off the developer's lien since the overall cost remained an excellent deal and the borrower was protected because the issues were cleared prior to close.

Fix and Flip In Chicago Suburbs

The "Rolodex" Saves a Rehabber From A Gruesome Basement Discovery

An investor client purchased a well-maintained home from an online auction. After spending $25,000 on repairs, the home only had about a 20% profit margin. The basement was already finished, but as the rehabber was completing the scope of work and replacing a window in the basement, he discovered that the wood was rotting beneath it. Upon further inspection, he found that the entire foundation was crumbling in some areas and completely missing in others. This issue was not evident during the walkthrough, as layers of plaster and concrete patch had been concealed beneath a fresh coat of drywall.

The rehabber was managing several projects simultaneously and had maxed out his leverage loan. Fixing the foundation would require over $20,000 and significant effort, as the walls needed to be shored up and a new foundation poured. Unfortunately, they could only extend a 20% credit, and the rehabber could only contribute 20% of the costs.

Remembering a positive experience with a foundation contractor from a previous project, Brian reached out to him, explained the situation, and negotiated a solution. The contractor agreed to handle the repairs for 40% of the total cost, allowing him to wait until the home was sold to collect the remaining 60% at closing. The contractor immediately got to work and completed the job within a week, saving the rehabber from delays, loss of profit, and a significant headache.

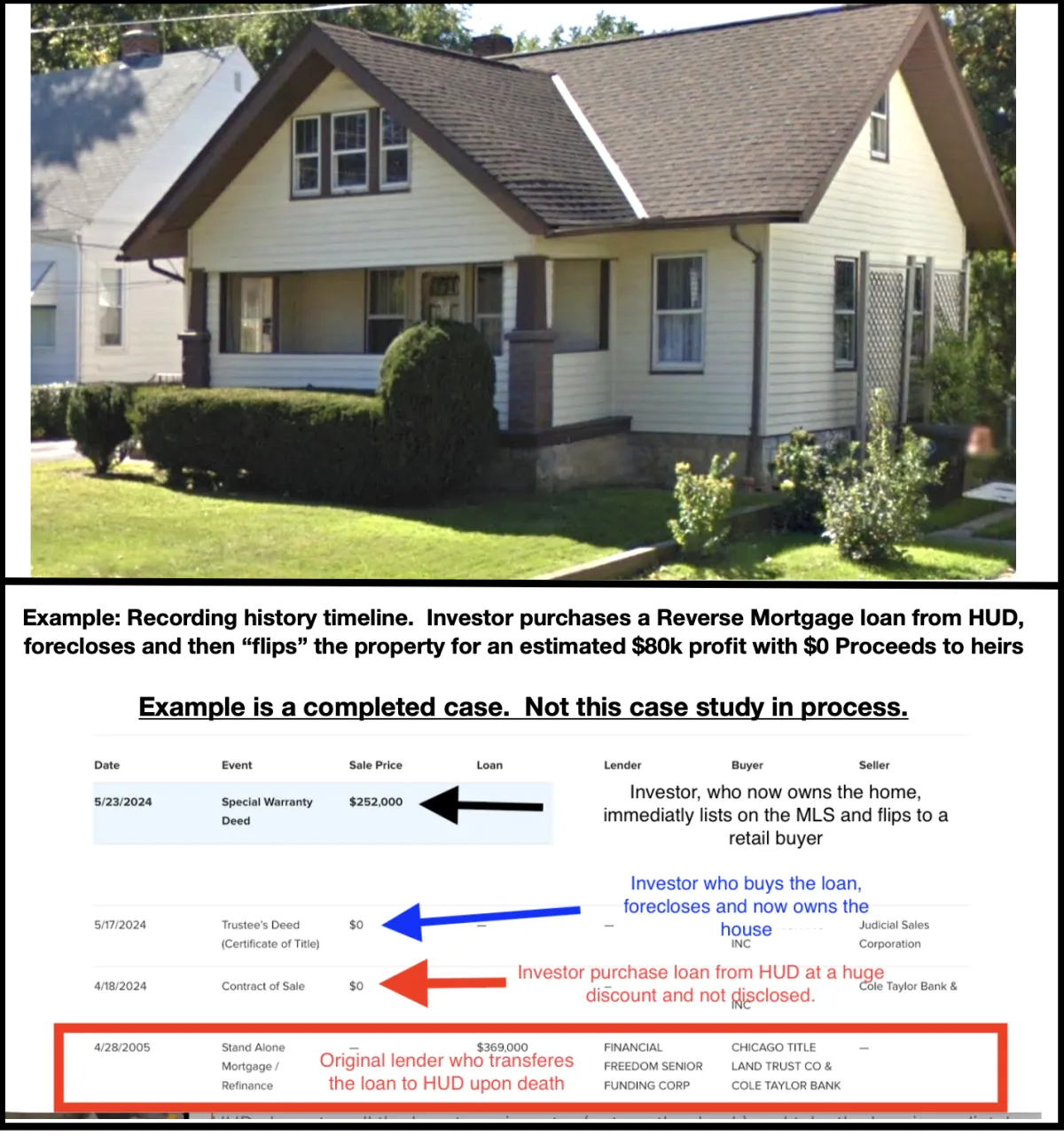

In Process: Reverse Mortgage Funds Recovery for Estate

Understanding how an estate can maximize it's value when it involves a Reverse Mortgage Foreclosure with no equity, starts by seeing what happens "behind the scenes"

This executor was referred to Brian by a legal advocate at AARP. She is the heir of a beautiful classic Sears home that was upside down on a reverse mortgage.

All reverse mortgages are backed by HUD (FHA), which means that if a lender experiences a loss in foreclosure or anticipates a loss, they have the option to transfer the loan to HUD, which will cover any losses for the lender. It’s important to note that the FHA insurance associated with the loan is for the lender's protection, not the borrower’s.

Understanding the behind-the-scenes processes is crucial to realizing how funds can be recovered, even when it seems like there is none available.

In this case, the lender transferred the loan back to HUD upon recognizing that they would incur a loss due to default. They assessed the value of the house against the amount owed on the loan. The property's value was less than the loan balance, meaning it was "upside down."

The trigger for this analysis was the death of the borrower. With a reverse mortgage, the loan automatically goes into default upon the borrower's death, allowing the lender to foreclose immediately. Unlike a traditional mortgage, there is no recourse for the borrower or heirs regarding any deficiency resulting from a foreclosure.

As soon as this loan became eligible for foreclosure, it was sent back to HUD, which had a couple of options:

Option 1: Start the foreclosure process on the mortgage with a loan balance of $148,000. The property value was estimated at around $110,000, so if the home goes to sheriff's sale and an investor buys it for $110,000, HUD would incur a loss of about $38,000.

Option 2: Rather than initiating the foreclosure process and managing all the associated work, HUD chose to sell the loan to an investor (not another bank) and take the loss immediately. The loan was likely sold for around $90,000, but this transaction isn’t recorded in the public domain like a typical sale. The only public record is that HUD transferred the loan to a new "lender," who then filed for foreclosure for $148,000.

In most cases, these investors do not sell the home at auction. Instead, they typically retain the property after foreclosure with the intention of “flipping” it to a retail buyer.

Thus, the investor ends up with a home purchased for approximately $90,000 that is worth $165,000 to a retail buyer, without needing to do any renovations. This results in a gross profit margin of $75,000. Unfortunately, after the foreclosure process is complete, the heirs have no leverage to recover any of this profit.

However, it’s important to remember that prior to the final foreclosure date, the estate still owns the house, and there are several options available to recover some of the funds. We will provide an update on the outcome of this case once it is resolved.

Contact Brian About Reverse Mortgage Funds Recovery

Chicago Hard Money Portfolio

Short Term Bridge / Investor Fix & Flip Funding

Kalex specializes creativelyt structuring deals to help investors and businesses maximize opportunities and solve problems. Here are some of the things we can assist with and fund..

Asset based investment funding without credit checks, appraisals or verification of income or assets

Quick Funding for Purchase and Rehab

Sherrif's sale

"No Value Add" Bridge for imterium funding

Second position liens

Joint Ventures

Funding payoff of liens and settlements for pending litigation

Buyouts of partners and heirs

Various types of interim funding

Foreclosure Soloutions & Reverse Mortgage Funds Recovery

Individuals, companies and heirs see millions of dollars of hard earned equity vanish in the foreclosure process in Illinois EVERY SINGLE DAY. There are several ways that Kalex can help an stop the foreclosure process and mitigate loss. Each situations has a unique solution but some of those ways include....

Identifying and recovering funds in A Reverse Mortgage, even when there is No Equity.

Emergency "Last Minute" Funding

Cash Purchases with back end profit share

Discounted payoffs through Lender Negotiations

Note Purchases

Lump Sum Settlement Offers

Foreclosure Sale Redemption Funding and Proceed Recovery

Zero upfront cost Foreclosure Litigation Attorney Referrals

Brian O'DEa

CFO

Brian is the Chief Funding Officer and has closed 1,000's of real estate transactions as a lender and investor. Over his 20 year career, Brian has helped a wide rage of clients from retail homebuyers, to independent investors to large institutions like Blackstone Companies.

He has a stellar reputation in the industry and a spotless track record operating as a lender, investor, Realtor, contractor and property manager.

He has professionally coached 100's of investors and Realtors and helped them grow their businesses. At Kalex, he provides the same value to our Chicago Clients by working with them hand in hand from the initial consult and through closing.

Our clients leverage Brian's extensive experience in the distressed property market, foreclosure process and marketing to maximize profits and increase volume.

Brian is also one of the nations leading experts in Reverse Mortgage Defaults and has consulted for large law firms, AARP and assisted in helping maximize the assets in estates.

He approaches every conversation with the goal of helping people grow thier wealth through real estate. The value in his consultative approach to every call is reflected in our clients loyalty and thier valued referrals.

DISCLOSURE: Kalex Capital is a consultant for qualified expierienced real estate investment business and does not offer services, consulting or lending on owner occupied residents or consumers. The programs on this page may be from Kalex Capital's Funds, it's partners or referrals to other lenders. Highlights for each product in the Nationwide Products section are features of different products under its category and are not not guidelines for a single program. Certain states are excluded from "Nationwide" and the program areas change on a regular basis. All rates and programs are subject to change and any information provided on this website is for informational purposes only and are not commitments to lend. Kalex Capital is a business to business consulting firm and not a bank or consumer lending institution. Consulting on Reverse Mortgage Defaults are done through the estate and the attorney who represents the estate. Kalex Capital Address: 4023 N Kilbourn Ave Chicago, IL 60641 312-725-2720